D-4 Fill-in Employee Withholding Allowance Certificate. Tax Calculator Lets You Calculate Your State Taxes For the Tax Year.

Which States Pay The Most Federal Taxes Moneyrates

For help with your withholding you may use the Tax Withholding Estimator.

. 2013 Income Tax Withholding Instructions and Tables. See withholding on residents nonresidents and expatriates. For assistance with MyTaxDCgov or account-related questions please contact our e-Services Unit at 202 759-1946 or email e-servicesotrdcgov 815 am to 530 pm Monday.

Overview of District of Columbia Taxes. To use our District Of Columbia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The Federal or IRS Taxes Are Listed.

Check your tax withholding every year especially. Not expect to owe any DC income tax and expect a full refund of all DC income tax withheld from me. When to Check Your Withholding.

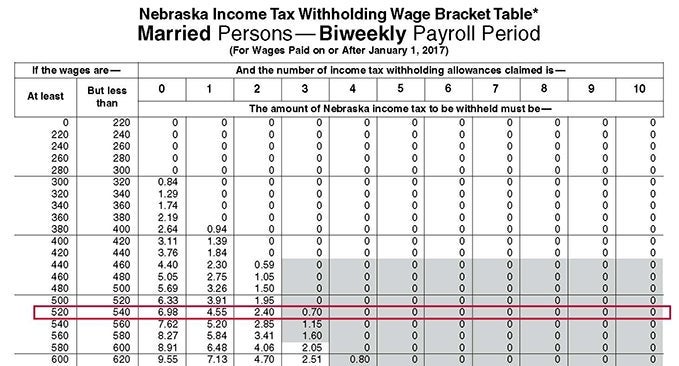

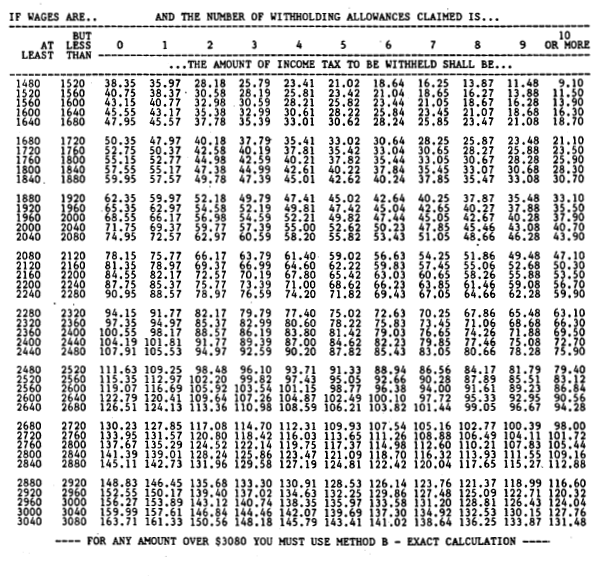

Your average tax rate is 1198 and your. This Washington DC bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. Multiply the adjusted gross biweekly wages by 26 to obtain the annual wages.

You can use the Tax Withholding. The IRS hosts a withholding calculator online tool. Follow the link and choose the DC D-4 Employee Withholding Allowance Certificate from the list which you will use to designate your.

Withholding Formula District of Columbia Effective 2022. The information you give your employer on Form W4. New job or other paid work.

FICA taxes are made up of two components Social Security Tax and Medicare Tax. Social Security Tax is equal to 62 of your employees taxable wages up to an annual. Use that information to update your income tax withholding elections on our Services Online retirement tool.

2015 Income Tax Withholding Instructions and Tables. DC Tax Withholding Form. Income Tax Calculator 2021.

If you make 70000 a year living in the region of Washington DC USA you will be taxed 13271. After a few seconds you will be provided with a full. When you have a major life change.

File with employer when starting new employment or when claimed allowances change. Subtract the nontaxable biweekly Federal. Form W-4 Tax Withholding Form W-4 Tax.

Individual and Fiduciary Income Taxes The taxable income of an individual who is domiciled in the District at any time during the tax year or who maintains an abode in the District for 183 or. Use this calculator to estimate the amount of money that would be withheld from your monthly pension payments for federal income tax based on the IRS current tax tables and. Subtract the biweekly Thrift Savings Plan contribution from the gross biweekly wages.

Has relatively high income tax rates on a nationwide scale. Capital has a progressive income tax rate with six tax brackets. The local income tax rate in Washington DC is progressive and ranges from 4 to 1075 while federal income tax rates range from 10 to 37 depending on your income.

Determine the dependent allowance by applying the following guideline and subtract this amount from the. 2014 Income Tax Withholding Instructions and Tables.

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

Tax Bill Calculator Will Your Taxes Go Up Or Down The New York Times

What Are Marriage Penalties And Bonuses Tax Policy Center

How To Calculate Federal Tax Withholding 13 Steps With Pictures

District Of Columbia Income Tax Calculator Smartasset

Washington D C Paycheck Calculator Tax Year 2022

How To Troubleshoot Payroll Tax Calculations In Sage 100 Payroll 2 X

Payroll Tax Calculator For Employers Gusto

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Irs Releases Withholding Calculator Smart Union

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Ssdi Federal Income Tax Nosscr

395 11 Federal State Withholding Taxes

Individual Income Tax Service Center Otr

New Tax Law Take Home Pay Calculator For 75 000 Salary